CRED‘s New Feature: A Deep Dive into Personal Finance Management

Empowering Users with Financial Insights

Table of Contents

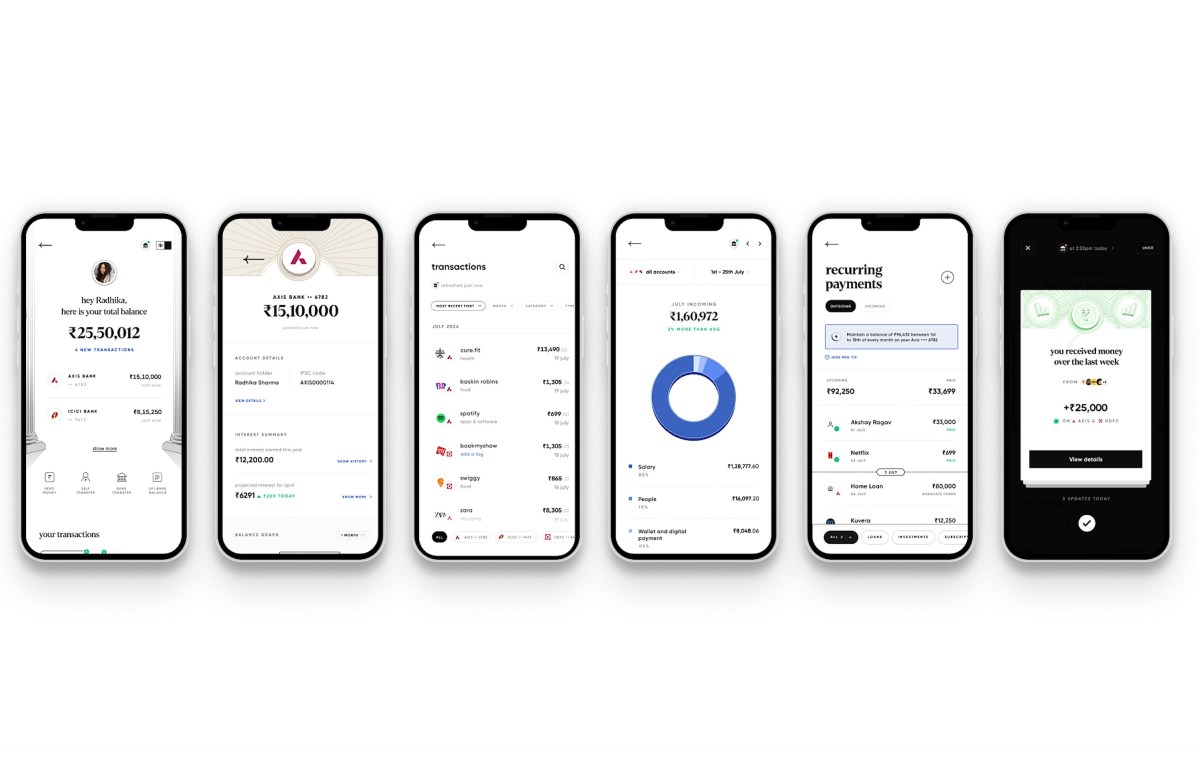

Indian fintech startup CRED is making waves in the financial technology landscape with its latest offering, CRED Cash. This innovative feature aims to empower users by providing them with a comprehensive view of their finances and actionable insights to optimize their spending and savings.

CRED, renowned for its credit card bill payment and consumer lending services, is now venturing into the realm of personal finance management. With CRED Cash, users can consolidate their financial data from various bank accounts, enabling them to track transactions, recurring payments (including SIP investments, rent, and salaries), and categorize expenses on a single dashboard. This centralized platform offers a clear picture of their financial health, allowing for better budgeting and decision-making.

Leveraging India’s Account Aggregator Framework

CRED Cash leverages India’s robust account aggregator framework, a system launched by the Reserve Bank of India to promote transparency and user control over personal financial information. This framework allows users to grant temporary, purpose-specific access to their financial data across multiple institutions through a secure and encrypted channel. By utilizing this framework, CRED ensures that user data is protected and handled responsibly.

Actionable Insights for Financial Optimization

The platform employs advanced data science algorithms to analyze the vast amount of transaction data collected from users’ accounts. This analysis generates actionable insights, helping users identify spending patterns, potential investment opportunities, and areas for financial optimization. CRED aims to empower users with the knowledge they need to make informed financial decisions.

Addressing the Fragmentation Challenge

CRED highlights a significant challenge faced by many Indians: fragmented finances across multiple platforms. With an average of 200 transactions per month, managing finances can become overwhelming and lead to suboptimal decision-making. CRED Cash aims to address this fragmentation by providing a unified platform for users to consolidate their financial data and gain a holistic view of their financial situation.

CRED’s Commitment to User Empowerment

CRED founder Kunal Shah emphasizes the importance of empowering users with financial knowledge and control. He states, ”We’ve built a product that improves every affluent person’s relationship with money and makes them less anxious about it through a trusted, insightful experience.” This commitment to user empowerment is evident in CRED’s continuous efforts to develop innovative features that address the evolving needs of its users.

A Growing Portfolio of Financial Solutions

CRED Cash is the latest addition to CRED’s expanding portfolio of financial solutions. The company has recently acquired Kuvera, a platform for mutual fund and stock investments, further solidifying its position as a comprehensive financial services provider. This strategic acquisition demonstrates CRED’s commitment to offering a wide range of products and services that cater to the diverse needs of its user base.

CRED’s approach to product development involves rigorous internal testing, with new features undergoing months of employee trials before being released to users. This meticulous process ensures that only high-quality solutions reach the broader user base, reflecting CRED’s dedication to delivering value and enhancing the financial well-being of its customers.